Melbourne has more than 100,000 vacant home, a new study has revealed, and suburbs with large Chinese populations are among those with the most empty properties.

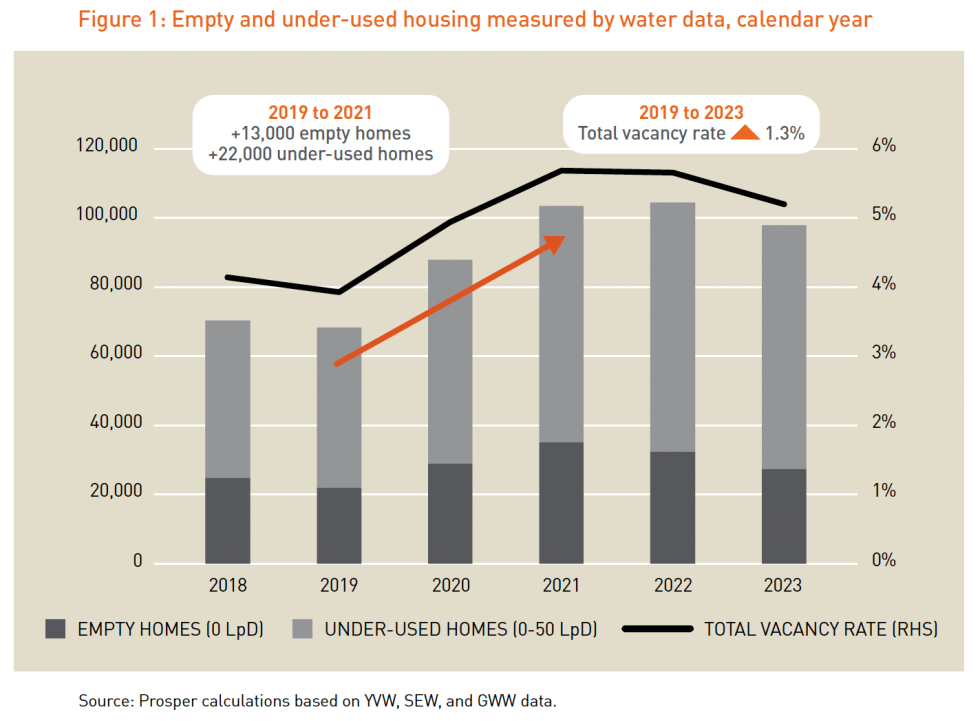

Prosper Australia’s 11th Speculative Vacancy report used water meter data to examine the extent of unoccupied housing, and found that in 2023 27,403 dwellings in metropolitan Melbourne were completely empty (1.5% of the total), and almost 100,000 (5.2%) were either empty or barely used.

The top five postcodes by zero-use vacancy in 2023 were Burwood, Box Hill, Malvern, Hawthorn and Glen Waverley, while the top Local Government Areas for low and zero-use vacancy rates were Melbourne, Whitehorse, Yarra, Boroondara and Merri-bek.

According to the 2021 Census, 39% of the Box Hill population had Chinese ancestry, along with 38% of Glen Waverley, 25,5% of Burwood, and 9.2% of Hawthorn.

The Melbourne LGA, which had the fastest growth in vacancy, had a Chinese population of 23%. Whitehorse is 26.2% Chinese, and Boroondara is 18.2%.

Prosper Australia Director of Research and Policy Dr Tim Helm said: “We found that over 27,000 homes, or 1.5% of all dwellings, were left entirely empty for the entire year of 2023.

“With the inclusion of under-used homes recording less than a quarter of the average single-person consumption over the year, a total of almost 100,000 homes, or one in 20 dwellings across the city, were vacant.

“That’s equivalent to two and a half years of new construction, which is enough to house everyone on the Victorian public housing waitlist twice over. It is a shocking waste that so many homes are left empty during a rental crisis, and it speaks to the state of inequality that these numbers keep rising.

“But we also need to recognise that it’s a predictable result of a tax system that prioritises speculative asset incomes over rental yield. Under-taxing capital gains and over-taxing productive activity enables this. It’s not surprising that so many investors prefer the flexibility of an empty property.”

Prosper’s study looked into unoccupied housing in Melbourne from 2019 to 2023, and found that long-term vacancy rates jumped more than 50% through to 2021, remaining elevated even in 2022.

“Our research shows that for every five homes built between 2019 and 2021, two more homes were added to the vacant stock and left unoccupied for a year or more.”

Last month a Foreign Investment Review Board (FIRB) revealed that foreign real estate investments worth $1.9 billion were approved in the last quarter of 2023 alone, with the bulk of purchasers from China, despite the vast majority of Australians being in favour of the government putting heavier restrictions on Chinese buyers.

Of the 1,580 approved proposals, $800 million of investment came from China, and $100 million each from India, Hong Kong, Taiwan and Vietnam.

A poll from earlier that month by the University of Technology Sydney’s Australia-China Relations Institute found that 83% of Australians believe the country should “restrict the amount of investment in residential real estate that is permitted from Chinese investors”.

80% agreed that foreign buyers from China drive up real estate prices, and 74% said Chinese investors have negatively affected the rental market.

Australian Bureau of Statistics data releaed in April showed that Australia’s Chinese-born population (not including Hong Kong, Macau or Taiwan) went from 432,400 and 1.9% of the population in 2013, to 655,760 and 2.5% in 2023.