Commentary surrounding the impact of migrants on Australia’s housing crisis varies, ranging from platitudes about how migration could fix the housing crisis, to assertions that immigration is the primary driver of prohibitive housing prices.

It is clear, however, that Australia is currently undergoing a severe housing shortage, which has caused significant tightness in the market and in turn caused prices to rise substantially and forcing rental vacancy rates to plummet.

Simultaneously, net overseas migration has risen to an all-time high – Australia let in over half a million new migrants in 2022/23.

These immigrants need housing, yet the news media ignores the demand-side pressures this intake creates in order to focus almost exclusively on supply-side pressures. Journalists routinely highlight how this crisis is due to a lack of housing, supposedly remedied by massive government spending on social housing.

Meanwhile, discussion of migration as a factor in the housing crisis is met with accusations of racism, yet even in spite of this, both the Labor and Liberal parties have implicitly acknowledged an “immigration effect” by adopting commitments to lower immigration intake over the next decade.

What seems to be missing from the discourse is a quantitative examination of the relationship between immigration and housing. To dispel media lies, half-truths and misdirection about immigration effects on housing, The National Observer has used publicly available Australian Bureau of Statistics (ABS) data to investigate the numbers behind the housing crisis.

Once the ideological speculation is stripped away, the best available stats tell a clear story; Moallemi and Melser (2020) conducted a detailed analysis of the effect migration has on housing.

They showed that between 2006 and 2016, a 1% increase in immigration caused a 0.9% per annum increase in house prices. This effect was larger for the more recent years examined, as well as in the eastern states.

Of particular interest, the authors highlighted an increased influence of both Indian and Chinese immigrants on house prices, corresponding with the growth of those two demographics in Australia.

More recently, the International Monetary Fund (IMF) conducted a report into the macroeconomic impact of immigration into Australia. The IMF found that migration was positively correlated with the house price index and demonstrated significant increases in the five years following known historical migration peaks.

Given the high levels of recent migration into Australia, our analysis seeks to examine this effect with updated data and explore the monetary impact of migration on Australians looking to enter the housing market over the next 20 years.

Data for this study was taken from publicly available sources, primarily the 2011, 2016 and 2021 censuses conducted by the ABS, focusing on the Level 2 Statistical Areas in the Eastern states. Moallemi and Melser’s methodology was leveraged to uncover the most recent effects of immigration on housing. Importantly, there are a few statistical considerations that have been considered to ensure the results are robust.

The number of immigrants in a particular area is influenced by the existing number of immigrants and the current house prices in that area. This causes an immigration effect to be correlated with the error term in an ordinary linear regression analysis. As done in Moallemi and Melser, we have adjusted for these effects.

Furthermore, as immigration is not the only impact on house prices, a series of covariates were included in the model to control for other drivers. These covariates isolate the effect of immigration on housing and were included based on the work of Moallemi and Melser, along with other variables considered to be influential in housing market fluctuations. Covariates used in the model include: median age, median income, population density, state, building approvals, level of tertiary education, apartment ratio, and the value of new construction.

In plotting the percentage change in migrant population against the log of the change in house price, a clear positive relationship exists between immigration and house prices. When accounting for the covariates, immigration is a statistically significant explanatory variable for house prices, with a p-value < 0.001.

Other significant predictors included median age, population density, state and number of building approvals. Interaction effects uncovered a stronger effect of migration on housing in New South Wales and Victoria. For Sydney, we found that a 1% increase in immigration contributes a 0.8% increase in house prices, broadly consistent with the work of Moallemi and Melser.

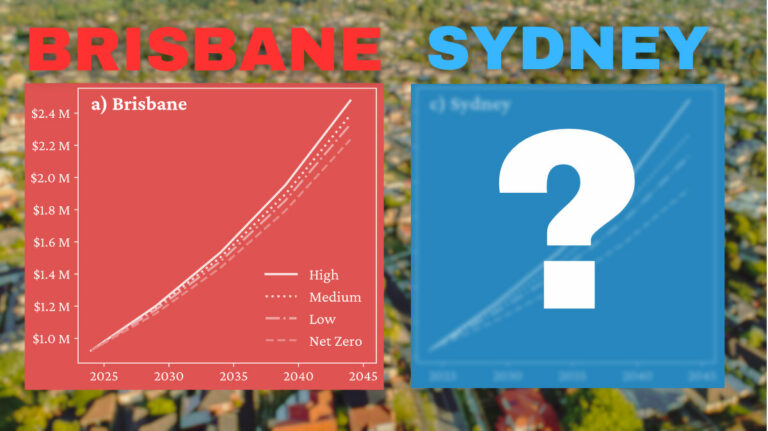

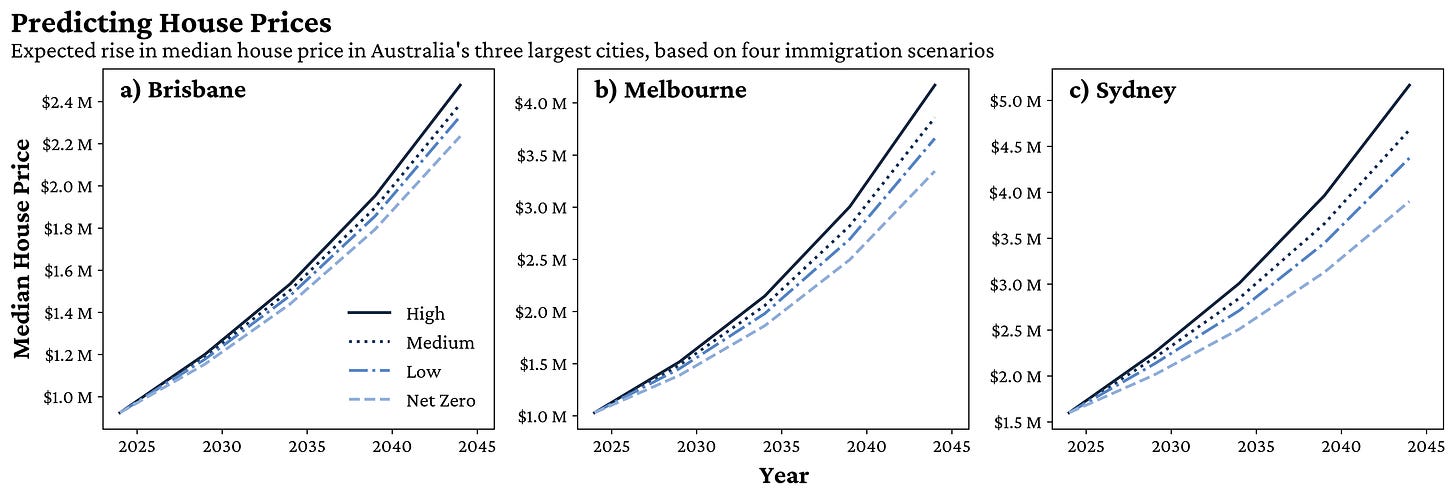

To quantify this effect for the average Australian, we have used the model and four immigration scenarios to examine the effect of immigration on the median house price in Sydney, Melbourne and Brisbane over the next 20 years.

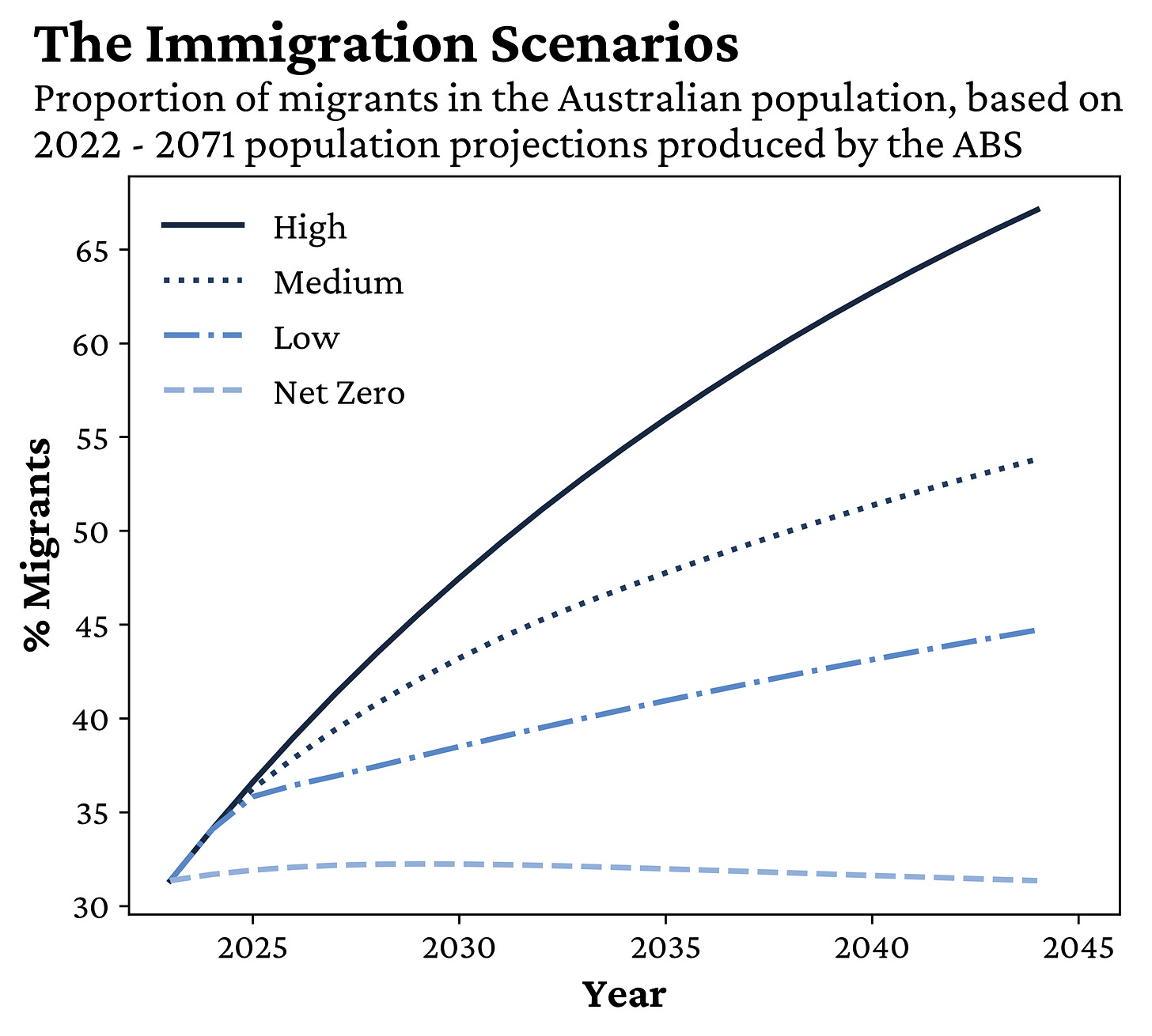

These migration scenarios are based on the ABS’s 50 year population projections and have been amended slightly to account for known migration during 2022 and 2023, and to match the below scenarios. The four scenarios are:

- High: Assumes a constant level of migration set based on the 2022/23 intake.

- Medium: The current Labor governments desired immigration levels, going from a high in 2022/23 steadily decreasing until a level of 275,000 per year, approximately half of the current levels.

- Low: The Liberal Opposition’s immigration proposal to reduce permanent migration to 140,000 people per year.

- Net Zero migration.

Applying these immigration scenarios to the model reveals some stark effects of migration over the next 20 years.

In each of the cities examined, an immigration rate above net-zero increases the median house price.

Under the high immigration scenario, the model predicts house prices would be 32%, 24% and 10% higher than a net zero scenario in 2044 for Sydney, Melbourne and Brisbane, respectively. This corresponds to an additional $1.2 million in the median house price in Sydney, $800,000 in Melbourne and $200,000 in Brisbane.

Even under the low migration scenario, Sydney house prices are expected to increase by nearly half a million dollars ($500,000), compared to a net-zero scenario over the next 20 years.

Historically, Brisbane has experienced lower migration intakes than Sydney and Melbourne. Therefore, there are lower effects in Brisbane. Under the low migration scenario, there is only a modest $94,000 increase in the median house price by 2044. As Brisbane continues to expand in the lead-up to the Olympic Games in 2032, migrant flows are expected to increase, which may lead Brisbane to experience a similar trend to Sydney and Melbourne.

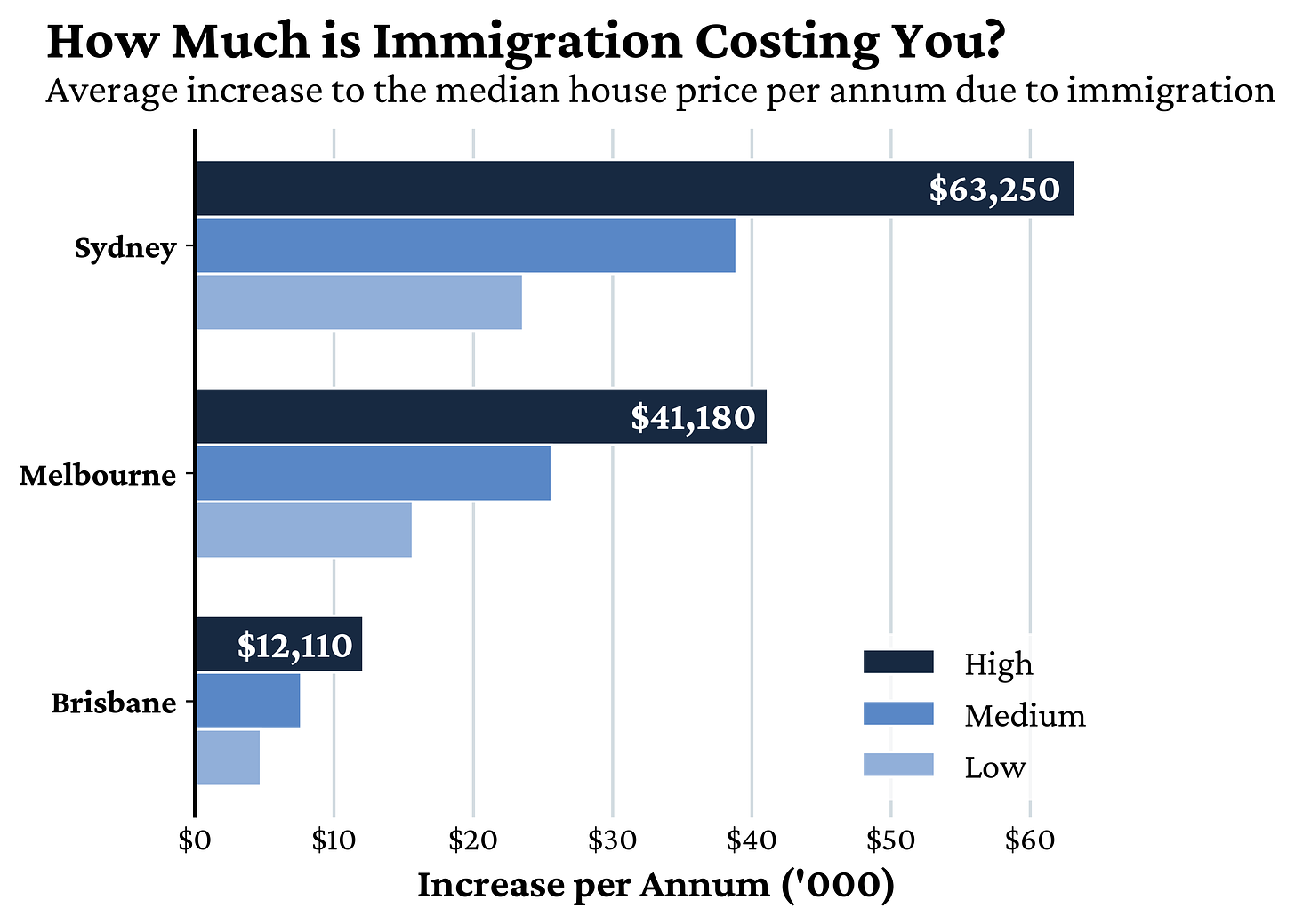

Yearly increases in the median house price show much the same trend. Sydney has the highest impact, with the high immigration scenario seeing an increase in the median house price of $63,250 per year compared to net zero. This is closely followed by an increase of $41,180 per year in Melbourne and $12,110 in Brisbane.

In Sydney, even the low immigration scenario will increase the median house price by $23,600 per year and this almost doubles for the medium immigration scenario. Similar trends are seen for Melbourne and Brisbane, with the magnitude of the cost reduced due to the current cheaper median house prices and different immigration flows compared to Sydney.

Whilst this analysis shows that immigration is not the sole cause of the housing crisis, with house prices predicted to continue to grow under a net-zero scenario, this model clearly demonstrates that migration has a positive and statistically significant impact on the housing market across Australia’s major cities.

The expected increases in house prices of many tens of thousands of dollars each year does reveal that migration is exacerbating the upward pressure on housing, pushing it further out of reach of more and more Australians.

The National Observer will release part 2 to this story, examining more socio-economic effects of immigration in a future publication.

Written by Flynn Holman, find more of his content on ? @Flynn_Holman_. Article edited and data compiled by Matthew Fischer, find more of his content on Telegram.

This article originally appeared on The National Observer and is republished by The Noticer with permission.