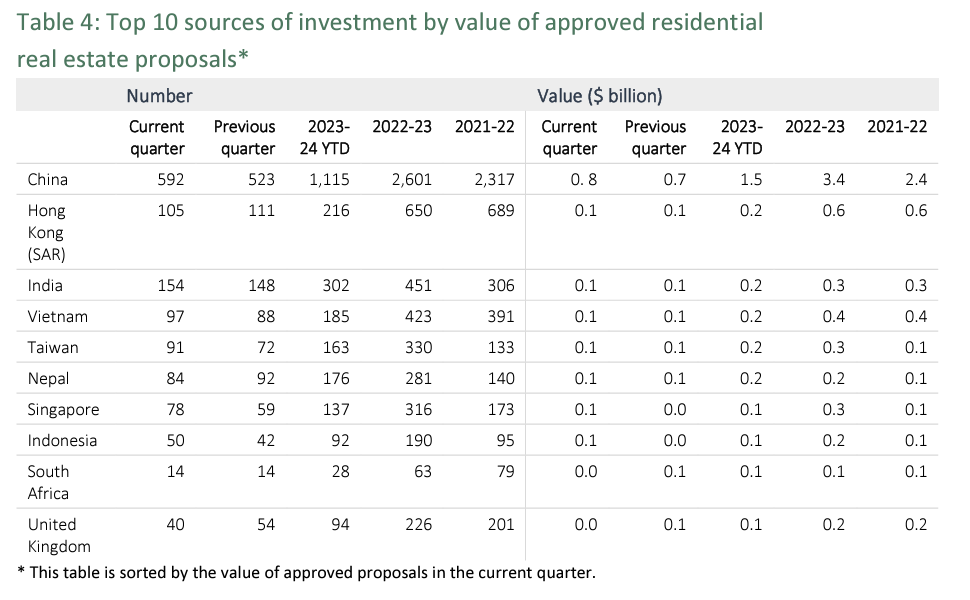

Foreign real estate investments worth $1.9 billion were approved in the last quarter of 2023, with the bulk of purchasers from China, despite the vast majority of Australians being in favour of the government putting heavier restrictions on Chinese buyers.

A Foreign Investment Review Board (FIRB) report released on Friday on the October to December quarter showed that of the 1,580 approved proposals, $800 million of investment came from China, and $100 million each from India, Hong Kong, Taiwan and Vietnam.

For the 2023-23 financial year there were a total of 6,576 residential real estate proposal approvals, up from 5,433 the year previous, while the first two quarters of the 2023-24 have seen 2,954 approvals.

Chinese buyers had 592 successful approvals in the December quarter, followed by 154 from Indians, and 105 from Hong Kong residents.

Foreign buyers do not include permanent residents or Australian citizens, New Zealand citizens who hold or are eligible for a special category visa, or joint tenants purchasing with an Australian citizen or permanent resident spouse, or New Zealand spouse with special category visa eligibility.

Foreign investors can also be corporations and foreign governments.

A poll from earlier this month by the University of Technology Sydney’s Australia-China Relations Institute found that 83% of Australians believe the country should “restrict the amount of investment in residential real estate that is permitted from Chinese investors”.

80% agreed that foreign buyers from China drive up real estate prices, and 74% said Chinese investors have negatively affected the rental market.

All results were at record highs since the ACRI began the survey in 2015, and the most recent poll also found concerns with Chinese international student numbers and investment in Australian infrastructure.

“Nearly three-quarters of Australians (73%) believe that ‘Australian universities are too financially reliant on international students from China’,” the report noted.

“Australians are not supportive of the Australian government’s decision to allow Landbridge’s lease of the Port of Darwin to continue. Only 26% of Australians said that ‘The Australian government was right not to cancel or vary Chinese-owned company Landbridge’s 99-year lease of the Port of Darwin’.

“Just over six in 10 Australians (62%) said the Australian government should force Landbridge ‘to sell the port back to the government’.”

An Australian Taxation Office (ATO) report also released Friday showed that during the 2022-23 financial year foreigners bought 5,360 homes worth $4.9billion, up from 4,228 at the value of $3.9 billion in the previous year.

“Across Australia, purchase transactions increased by 26.8%. The state with the greatest number of purchase transactions for all property types in 2022–23 was Victoria, the same result as in 2021-22,” the ATO said.

” New South Wales had a decrease in property purchases of 1.2% and all other states had an increase when compared to 2021-22.

“Residential properties with values under 1 million dollars formed the majority of residential property purchase transactions, accounting for 78.2% of property transactions in 2022-23. This is an increase compared to 75.4% in 2021-22.

“Of the 5,360 purchase transactions in 2022–23, 164 registrants became a permanent resident or gained Australian citizenship during the year and are included in these statistics.”

Daniel Ho from Asian property portal Juwai IQI, Daniel Ho, told news.com.au that foreign buyers liked Australia because of the “strong economy, good education system and attractive lifestyle”.