In an ideal society, housing would always be affordable for working families and young couples who want families. Affordable housing is perhaps the single most important economic issue for nationalists, as it is one of the most straightforward ways to increase declining birthrates and encourage family formation, the lifeblood of any nation.

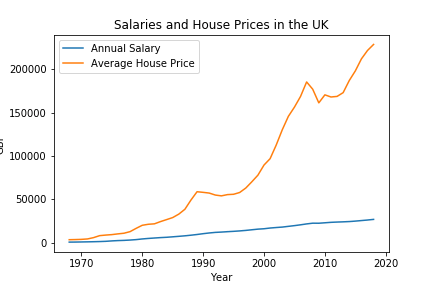

Currently, we are a long way off from this ideal. In the U.S., the National Association of Realtors’ Housing Affordability Index hit an all-time low in 2023, making it the worst year to be a new home buyer since records began. In England, only the top 10% highest income households can now buy an average-priced home house with fewer than five years’ worth of household income. The problem of housing inflation is just as bad for renters as it is for homebuyers: the average UK tenant pays more than a third of their income on rent, with one in five handing over more than half their income to a landlord.

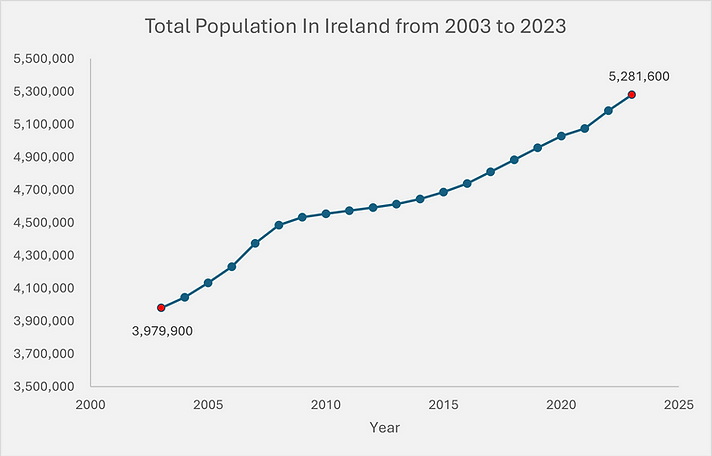

In recent years, unaffordable housing has become the central issue in Irish politics. Driven by mass-immigration, the population of Ireland is growing by four people for every house built. A staggering 69.9% of 25-year-olds in Ireland live at home with their parents, something that makes Ireland an anomaly in Western Europe. This has had a major impact on Ireland’s fertility rate: as recently as 2010, Ireland still had an above-replacement fertility rate of 2.05. Now, it stands at about 1.7, but for native Irish people it is likely lower, as new immigrants tend to have more children.

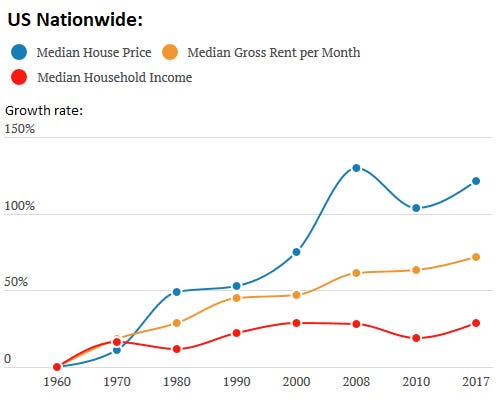

Not only is the ratio of home prices to median income higher than ever, but in response to the 2008 financial crash, many countries and individual financial institutions have introduced larger deposit requirements for mortgages ranging from 10-20% of the total, something unheard of for our parents’ or grandparents’ generation, and requiring young people without wealthy parents patronising them to have many years worth of income saved to approach home ownership.

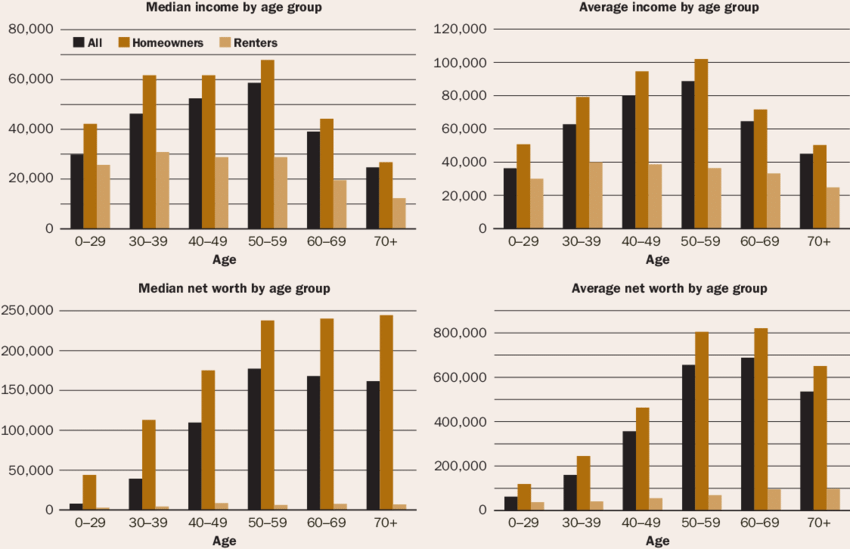

In the United States, this inequality between old and young on housing is so bad that boomers with no children at home now own twice as many large homes as millennials with kids.

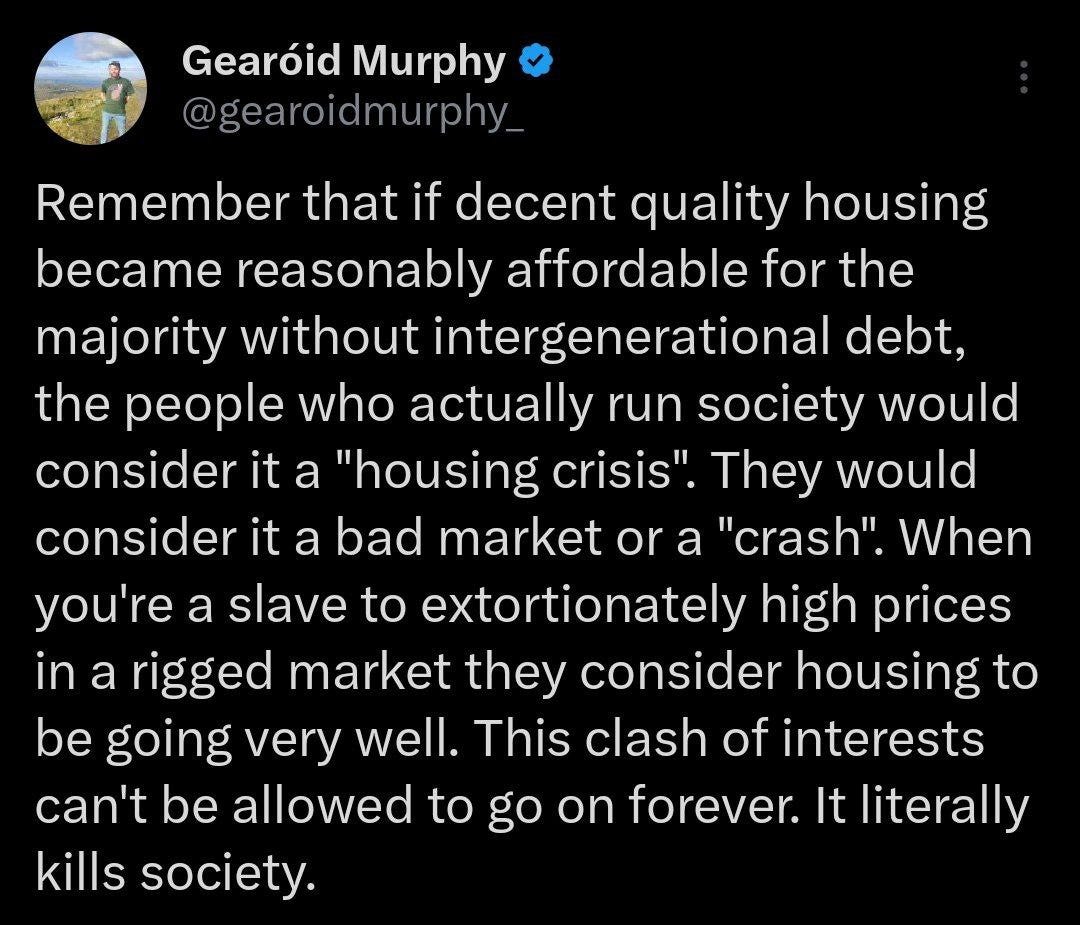

If this system looks like it’s designed to transfer wealth to homeowners at the expense of non-homeowners, that’s because it is. Housing policy in most Western countries is not really about housing at all, but about inflating real-estate prices indefinitely:

The United States subsidizes mortgage borrowing. It subsidizes property taxes. It subsidizes capital gains on your home. It subsidizes ownership over renting by taxing the income with which people pay rent but not the in-kind or “imputed” rent that homeowners get for free. It subsidizes the entire mortgage-lending enterprise with light regulation of systemic risk, periodic federal bailouts, and an implicit promise to keep providing them.

Every one of these policies encourages people to treat their housing as an investment and to sink as much money into it as they can, rather than investing their savings in their own education or businesses or in financial instruments like bank deposits, stocks, and bonds—things that make the economy more prosperous overall.

There is a basic contradiction at the heart of housing policy. Property values are simply a reflection of scarcity against demand, and boosting property values relies on increasing both, while maintaining affordability demands abundance and lower costs — mutually exclusive outcomes. We can’t make housing affordable for everyone while also treating it like a vehicle for building wealth for existing homeowners.

This sounds so obvious as to be banal, yet policymakers continually go before the electorate promising to achieve both outcomes, while critics of the housing crises rarely challenge the ponzi scheme of perpetual housing value growth that lies at the heart of the problem.

Gerontocracy

The thing about the growth of home values is it isn’t based on any great skill or productive contribution from the owners. It’s simply a wealth transfer from the rest of society based on circumstances largely outside the individual homeowners’ control. Breaking this down by age, obviously the people who have owned homes the longest have benefited most from this system, and each successive generation is having to sacrifice more to own a more costly home. This ponzi scheme then, is a great wealth-transfer from the young to the old. The Boomer with a house worth a million dollars, paid for with a couple of years wages, hasn’t worked harder or played the market more shrewdly than the millennial gathering ten years savings to get a mortgage deposit in his 30s, he was just in the market earlier.

What makes this especially egregious is this is just one among many ways in which the fruit of young people’s productivity is transferred directly to the old in historically unprecedented ways. If we were to draw up a society from scratch, we would probably say it’s better to give people a small fortune at the beginning of their life — when they can use it to start a business, buy a home, provide for a large family — than at the end of their life. And yet the Western welfare state has become a great system of wealth transfers to the old. In France:

One third of all public money spent in France, around €500 billion a year, goes on pensions – as much as the whole of the direct government budget for everything else, from education to defence, to transport, to paying for the national debt.

10 of every 30 euros paid in tax by a young French person is going directly to pensions, all while the same pensioners watch the value of their property compound exponentially at the expense of young, non-homeowners. The number is similar across other Western countries, with the burden on working people growing as the share of retired people increases due to declining birthrates and longer life-expectancy. One remedy to that would be to increase the retirement age slightly, but when a Macron government tried to do this — from a very modest 62 to an also modest 64 — the French brought a million people to the streets in protest and strikes, and future governments may yet reverse this change.

At the heart of the political intransigence on fixing the housing ponzi scheme is the reality that the West is essentially a gerontocracy. France is just one example where the old exert far too much influence through protest and voting. Ireland faced very tough economic decisions after the 2008 financial collapse, which suddenly created a massive public spending deficit for the Irish state. Faced with the necessity of austerity, the government had two choices: raise taxes or cut government spending. In cutting spending, the most obvious targets for the chop were state entitlements for people that didn’t need them. This is why the Fianna Fáil-Green government removed an automatic entitlement to Medical Cards and free healthcare to over-70s. This meant older people below a threshold of income would still receive Medical Cards, but wealthier pensioners would have to pay their own way — the same rule that applies to under 70s.

This sparked some of the largest protests against any government austerity measure. Being political opportunists, the opposition Fine Gael and Labour party seized on the opportunity and became passionate advocates for the universal right of old people to free healthcare. Fearing their political future, individual government TD’s revolted publicly, and eventually the government reversed the policy. Of course, it did not reverse its planned austerity measures, but instead shifted the burden to younger, working people at a lesser political cost. Younger people suffered the costs, while pensioners were remarkably well protected throughout the years of austerity budgets. When the economy recovered, no area rebounded harder than the housing market — since 2013, Irish housing prices have increased by a staggering 153%. Wealthy pensioners received another enormous, unearned boost in the value of their assets despite making far less of a contribution to the austerity Irish people suffered, while the austerity generation entered their 30s with most still unable to own a home.

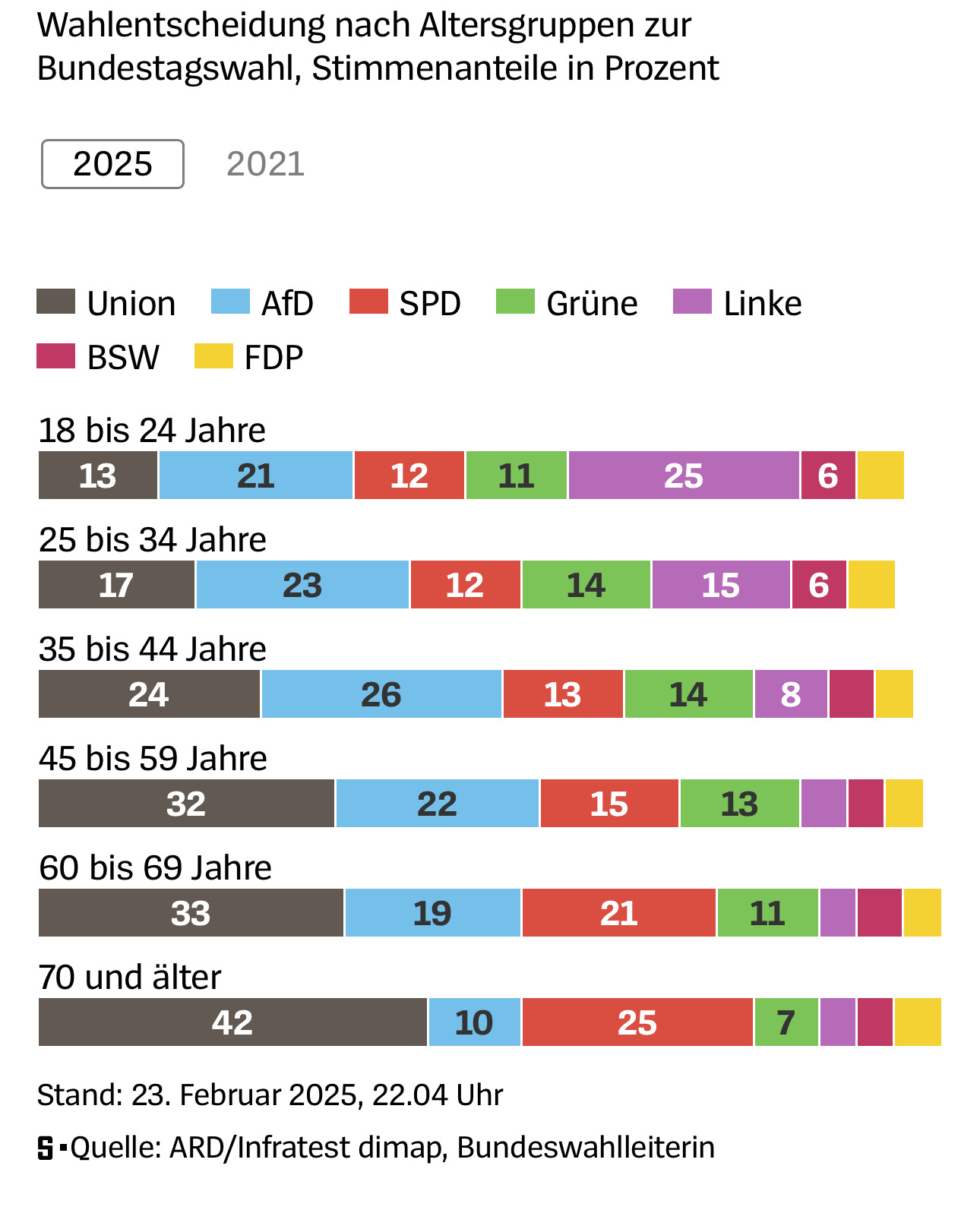

Old people exert more influence in Western mass-democracies than they have under any system. Not only are their numbers a greater share of the overall population than ever, but they have consistently higher voter turnout rates. Young people with jobs and families have less time to spend following politics, attending protests, petitioning their local representatives or voting. And while the majority of young people were supportive of things like keeping the retirement age in France and protecting pensioner’s medical cards in Ireland, old people will rarely come out to support policies that hurt the young, especially if it is any kind of wealth transfer from the old.

Human Quantitative Easing — The Economics of Gerontocracy

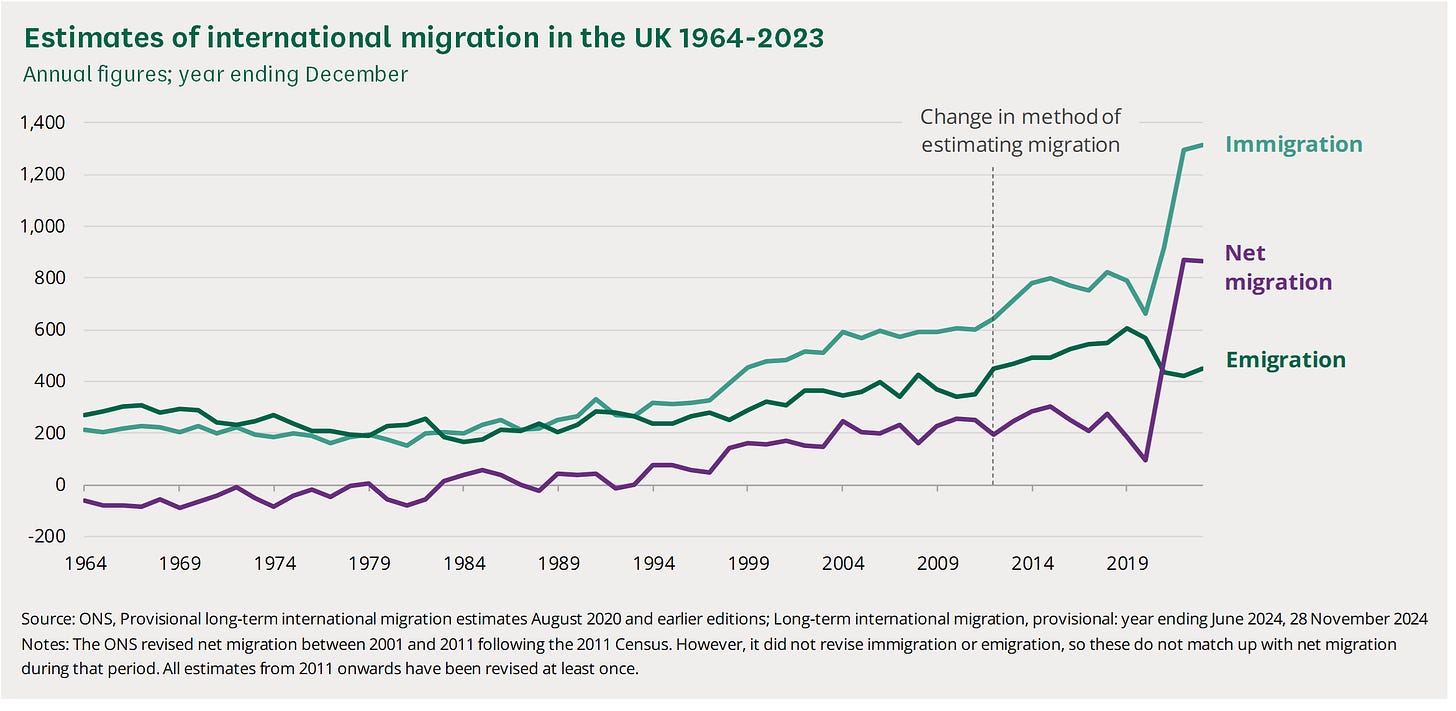

Since property values are a reflection of scarcity, a surefire way to keep the ponzi scheme of perpetual price increases going is to increase the population. But since birthrates are declining, this can only be done through mass-immigration. Of course, low-skilled immigration has other benefits to asset and business owners, like keeping labour costs low and increasing consumption and total economic output. This strategy, in the words of conservative writer Tom Jones, is ‘Human Quantitative Easing’:

Human Quantitative Easing is the method by which government allows geographically rooted industries, which cannot offshore their workforce to lower wage economies, to satisfy their need for cheap labour by importing the same workforce to the UK — with government providing a subsidy, if required, in the form of services and welfare payments.

That this is the policy of Western — especially anglosphere — governments was visible after COVID, when many countries began to record record numbers of new immigrants. Boris Johnson’s time in office brought so many new migrants to the UK that it has been termed the “Boriswave”. And, as Johnson himself explained, the massive rise in immigration “was because his government had to “deal with inflation” after the pandemic and that meant getting in “hands to do the work” to prevent wage costs spiralling.”

Of course, there is never really a “labour shortage” in low-skilled jobs, and concern about wage costs spiralling is a concern of business owners. For the low-skilled workers who would benefit from higher wages, this would be a good thing. Behind all the jargon about labour shortages and curbing inflation, politicians like Johnson have been quite honest that their strategy is to keep wages low (and keep nominal growth high for wealthier asset-holders) by importing low-skilled foreigners.

Property is also a big part of the equation. Australia is a good example: when polled, a majority of the population have always favoured a more restrictive immigration policy, yet the borders have been opened by successive governments for decades. One study convincingly attributes this dissonance to the influence of “the growth lobby”, a lobby concentrated “among interests based in housing, land development and construction.” The growth lobby was responsible for establishing formal lobby groups like the Australian Population Institute, at the launch of which Australian business leaders were told Australia “should pursue a vision which looks ahead 50 years to a democratic, secure, prosperous, fair and pluralist Australia with a population of 50 million people.”

Australian property developers have often been among the most bold proponents of an expansive immigration system. In 2006 Harry Triguboff, a property developer and one of Australia’s 10 richest people, called for a “massive boost to immigration” aimed towards a population of 150 million by 2050. After COVID, the same voices were the loudest demanding a return to open immigration. Ken Morrison, the CEO of the Property Council of Australia, was one among many representatives of the sector demanding the Australian government make it a priority to “restart net overseas migration”. Morrison “singled out population growth as one of the nation’s “big economic engines”, which meant restarting net overseas migration “must now be a priority.”

Immigration is very big business for property owners. Its effect is far greater even than on wages. Although pitifully few studies have been done to study the impact of immigration on housing costs, the results have been remarkable. A study from Spain looked at a 10 year period from 1998-2008 where immigration increased the working-age population by 17%. The study estimated that:

This inflow increased house prices by about 52% and is responsible for 37% of the total construction of new housing units during the period.

These figures imply that immigration can account for roughly one third of the housing boom, both in terms of prices and new construction.

Of course, open immigration policies are dressed up with the language of diversity and openness, and it is true that if our society had the same views about race our grandparents did they would not tolerate this much diversity, regardless of economic benefits. But when it comes to what’s really driving immigration growth, it’s the demands of business owners, bankers and property developers. There is a clear class interest for these people to continue to expand the economy through population growth.

The tragedy is that this should be an issue the left concerns itself with — just take the quote from Boris Johnson, he very clearly says government immigration policy is driven by the demand of capitalists to keep down wages. A smoking gun for the class-warriors one might think, but the left is more attached to diversity than any other plank of its platform, including workers’ rights. On the right, meanwhile, populist energy rarely singles out these lobbies, or talks about the problem of gerontrocracy. Trump has always made it a plank of his variant of populism to defend entitlements for old people. Right-populism focuses a lot on leftism and problems caused by migrants, but rarely is the incentive structure reproducing this migration policy challenged. Across the West Boomers remain the biggest voting-bloc for establishment parties, as evidenced again in Germany’s federal elections, where they voted less for AfD than any other age group. There is still a sense among right-wing populists though, that even despite their voting-patterns, older demographics are more on their side than other age groups.

In the case of targeting the entitlements of old people, the left will oppose austerity without providing an alternative other than “tax the rich”, and the right will talk about the state abandoning its vulnerable old people to serve globalists/climate change/migrants. There is just little incentive for anyone to tackle this problem politically, and so instead we get silence across the spectrum. We must all go on believing that we can have a housing policy that perpetually grows the value of houses, while also building enough to provide an affordable home for everyone, while also importing millions of migrants for natives to compete with on the housing ladder.

Fixing affordable housing is a necessary step in fixing the birthrate crisis and restoring an economy that serves the mass of working natives rather than endlessly channelling resources to unproductive rentiers. Politicians and policy planners will carry on claiming they want affordable housing while boasting about property-value increases, but until we recognise those are mutually incompatible, we’ll continue to watch the housing market fail spectacularly at what it’s supposed to do — provide houses.

This article originally appeared on Keith Woods’ Substack and is republished by The Noticer with permission.

His book Nationalism: The Politics of Identity is now available on Amazon. If you enjoy his writings, please consider purchasing it and leaving a positive review.

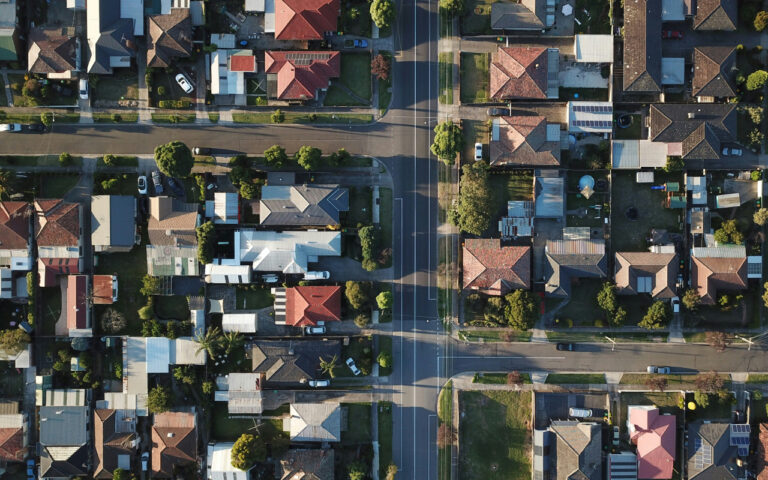

Header image credit: Tom Rumble on Unsplash.